Property backed loans SDI

Investment Description

- Gross yield of 13.0%

- Weighted average security cover of 1.49x

- Diversified pool of 280 borrowers

- Credit Rating: A (by CARE ratings)

- Monthly payout with maturity in March 2028

- Bankruptcy remote structure

Originator overview

- The loan pool is originated by Save Financial Services Private Limited, with AUM of ₹2,000cr and credit rating of ‘BBB’. (SDI rating is higher than the originator rating)

- Management Background:

- Ajeet Kumar Singh (Managing Director and CEO), has over 25 years of experience in the Financial Services and Banking sector across rural and urban areas. He has been instrumental in establishing alternative banking channel in 30 states for SAVE

- Gourav Sirohi (Group CFO), has over 15 years of experience in the field of Direct and Indirect Taxation, Finance, Treasury, Financial Audit, Company Law Matters, etc. Prior to SAVE, he has worked as Deputy VP – Finance at Fusion Microfinance.

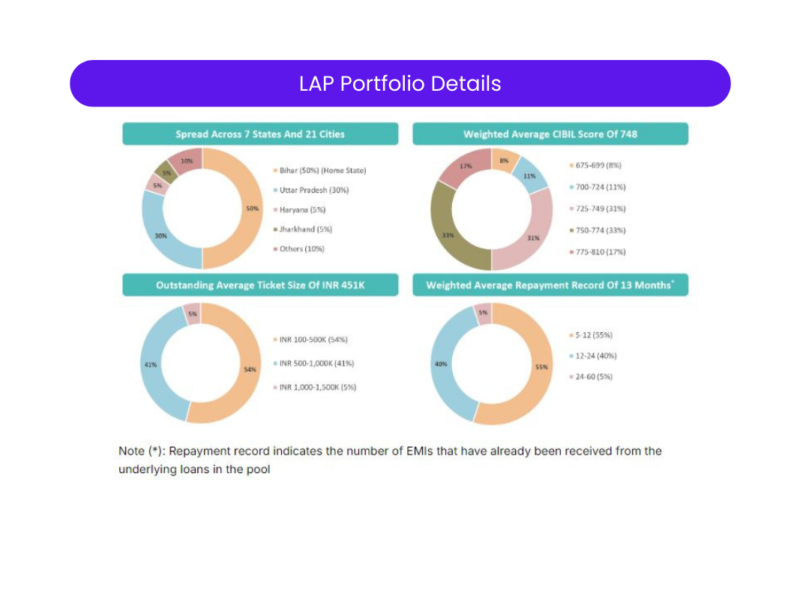

Borrower pool

- Weighted average CIBIL score of the underlying borrowers is 748

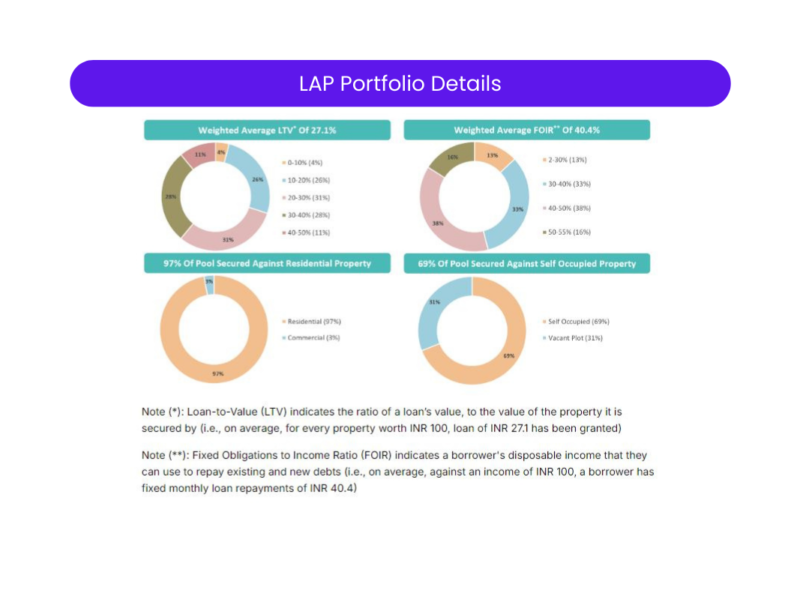

- Weighted average LTV of the underlying pool is 27.1% and the weighted average fixed obligations to income ratio of the borrower pool is approx 40.4%